With all of the talk of buying apartments to hide money, to shelter money or guard against currency devaluation or being expelled from your country because the Olympic ski jump was not finished on time, does it make sense to invest some of your capital in a Manhattan apartment? I think it pretty much always does given some factors. Continue reading Is it time to buy a Manhattan apartment for investment?

Midtown NYC Penthouse to ask $150mm

Now that One57 has set the bar at $100.47mm for its recent sale, other developers are trying to shatter that number. The NYDN is reporting that the 21k sqft penthouse which will occupy three floors at the converted Sony Building aka 550 Madison avenue in Midtown NYC will ask $150mm.

Many industry insiders feel that there are already too many luxury properties on the market and in the pipeline, so let’s see how this turns out. 520 Park avenue is also expected to take aim at Extell’s record with its own offering of 12k sqft for a reportedly $130mm which makes the $150mm of 550 madison look like a value play.

What the AG wants you to know before you buy a NYC coop or condo

Attorney General Eric T. Schneiderman has a buying guide for purchasers of NYC co-ops and condos. Highlights include:

1- The offering plan and why you should read the entirety

2- New construction and what guarantees are mandated by law

3- Recourse in case the actual apartment is different or if there are issues on your final walkthrough

4- What to do on your final walkthrough

Click the link below the read the AG’s guide to buying a NYC co-op or condo and good luck.

Good morning Central Park

Should you buy a property that is tax abated?

Seems like a very silly question. The obvious answer is if the taxes are lower than usual, you should it buy it, no? Well, the answer is not that simple. Recently, on a showing of a convertible 3bd condo on 5th avenue, I contemplated the question myself. There are 8 years left on the tax abatement for this building. So that means in this case the taxes will go up 20% every two years until they reach the market rate for taxes for the area. I think this is a point that not every buyer truly understands.

Continue reading Should you buy a property that is tax abated?

Manhattan buildings seek vanity addresses

The NYT has an interesting article this weekend in the Real estate section about buildings that have misleading addresses. I live and work in a building at 400 Central Park west where the entrance is on 100 street. This is not too bad in my opinion because we do have frontage on Central Park west: both the side of our building, garden and a parking lot. However, our neighbors to the west at 392 and 382 CPW are actually located on Columbus avenue but have what we call a vanity address. Continue reading Manhattan buildings seek vanity addresses

Buyers move closer to private schools

Thanks in no small part to the local private schools including Dalton(photo), several new developments on the Upper East side are experience a spike in their sales at this time. As parents begin to find out that their children have been accepted to schools on the UES, they start to make their plans to move to the neighborhood. Many of these parents are trading in their downtown apartments for family sized (2000 sqft or larger) apartments on the UES.

I have heard about this in relation to a spike of sales surrounding Avenues the World school which is located in the Chelsea area. Parents will be willing to commute for work but not for the children’s school according to the NYT article.

Is buying a luxury condo to turn into a rental a good invesment?

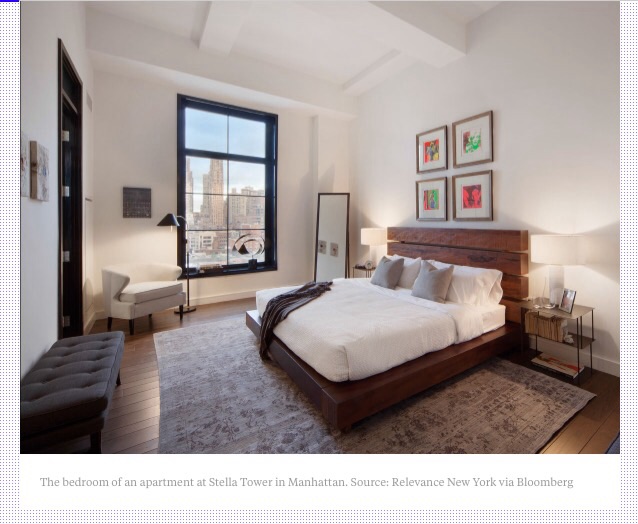

Bloomberg is reporting that buyers of luxury apartments from Downtown’s Stella Tower to One57 on Billionaire’s row are buying apartments to rent out. One such apartment was purchased on the 56th floor of Extell’s One57 for just over $10mm and is now on the lease market for $25,000 per month.

According to the streeteasy somewhere around 2% of the luxury condo purchases are being put back on the market for sale in an attempt to flip the property. This number has stayed consistent for the last several years. Developers of Manhattan luxury apartments price so accurately that flipping is pretty much out of the question. Recently, One Riverside Park on the upper west side, also an Extell Project entered the market and was slighly underpriced as evidenced by the velocity of contracts that were sent out immediately so they pulled it back off the market and raised the prices.

As a result, buying and then renting is the choice for investors. However, according to Jonathan Miller of Miller Samuel, there is not a demand for large luxury rentals so renting out and establishing a new rental price point could be a challenge and cut into the returns of the investor. Typically rates of return or cap rates hover around 3-4% for Manhattan apartments.

Central Park west apartment enters the market at $42mm

Apt 9BC at 101 CPW on Manhattan’s Upper West side has entered the market for $42mm. It offers 7000 +/- sqft plus exterior space, and 100 feet of frontage on Central Park. The property was purchased in 2003 for roughly $12mm and the owners spent 3 years renovated the apartment according to the broker. The monthly carrying charges for apt 9BC are $14,057 according to the listing on streeteasy.

The building itself is a prewar coop building with 18 floors and just under 100 units and occupies the block between 70-71 street on CPW. There are 4 other listings at 101 CPW for sale with 2 in contract. All 4 of the other properties are 3 bedrooms and the prices range from $4.99mm to $6.99mm.

Should you buy the first NYC apartment that you see?

The NYDN has an article about the impuslivenesss of some buyers who are snatching up the first property that they see. I don’t see this as a problem provided a few factors are in place: Continue reading Should you buy the first NYC apartment that you see?