313 West 138th street, one block west of Strivers’ Row in Central Harlem, has gone to contract. The property which has 5 studios and 3-1 bedroom apartments was asking $1.8 million. After a flurry of activity, it has gone to contract for more than the asking price.

313 W 138th street listing details

The Author-  Brian Silvestry , a licensed real estate broker, has been selling residential and commercial real estate since 1999. He has sold in every Manhattan market from Battery Park City to Washington Heights.

Brian Silvestry , a licensed real estate broker, has been selling residential and commercial real estate since 1999. He has sold in every Manhattan market from Battery Park City to Washington Heights.

by  Brian Silvestry

Brian Silvestry

One segment of the market that may benefit from the Tax Reform may be multi-family. According to Real estate weekly, some people may decide to rent instead of buying and rents may rise as a result. Also, foreign investors may move into more multi-family properties due to the decrease of the Corporate tax rate to 21%.

Rents have been declining for the last 2 years in the Manhattan market but if more people who can buy decide not to buy this can affect the rental market.

Also, if interest rates rise, this may be a secondary consequence of the new tax law, and they may affect the starter apartment market in Manhattan and increase the amount of renters.

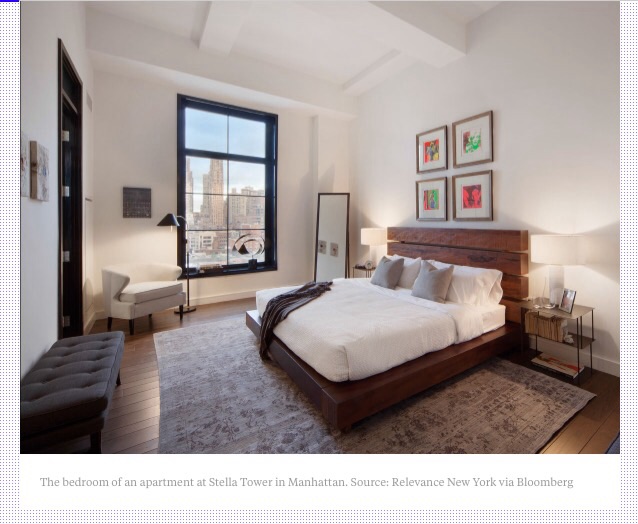

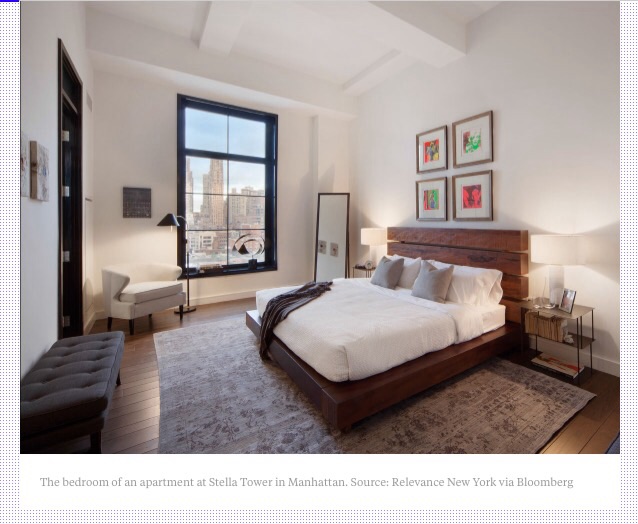

Bloomberg is reporting that buyers of luxury apartments from Downtown’s Stella Tower to One57 on Billionaire’s row are buying apartments to rent out. One such apartment was purchased on the 56th floor of Extell’s One57 for just over $10mm and is now on the lease market for $25,000 per month.

According to the streeteasy somewhere around 2% of the luxury condo purchases are being put back on the market for sale in an attempt to flip the property. This number has stayed consistent for the last several years. Developers of Manhattan luxury apartments price so accurately that flipping is pretty much out of the question. Recently, One Riverside Park on the upper west side, also an Extell Project entered the market and was slighly underpriced as evidenced by the velocity of contracts that were sent out immediately so they pulled it back off the market and raised the prices.

As a result, buying and then renting is the choice for investors. However, according to Jonathan Miller of Miller Samuel, there is not a demand for large luxury rentals so renting out and establishing a new rental price point could be a challenge and cut into the returns of the investor. Typically rates of return or cap rates hover around 3-4% for Manhattan apartments.

LINK

News about the NYC real estate residential and commercial markets provided and interpreted by an industry veteran licensed since 1999. Brian Silvestry of BSRG Inc. Licensed real estate broker

![]() Brian Silvestry , a licensed real estate broker, has been selling residential and commercial real estate since 1999. He has sold in every Manhattan market from Battery Park City to Washington Heights.

Brian Silvestry , a licensed real estate broker, has been selling residential and commercial real estate since 1999. He has sold in every Manhattan market from Battery Park City to Washington Heights.